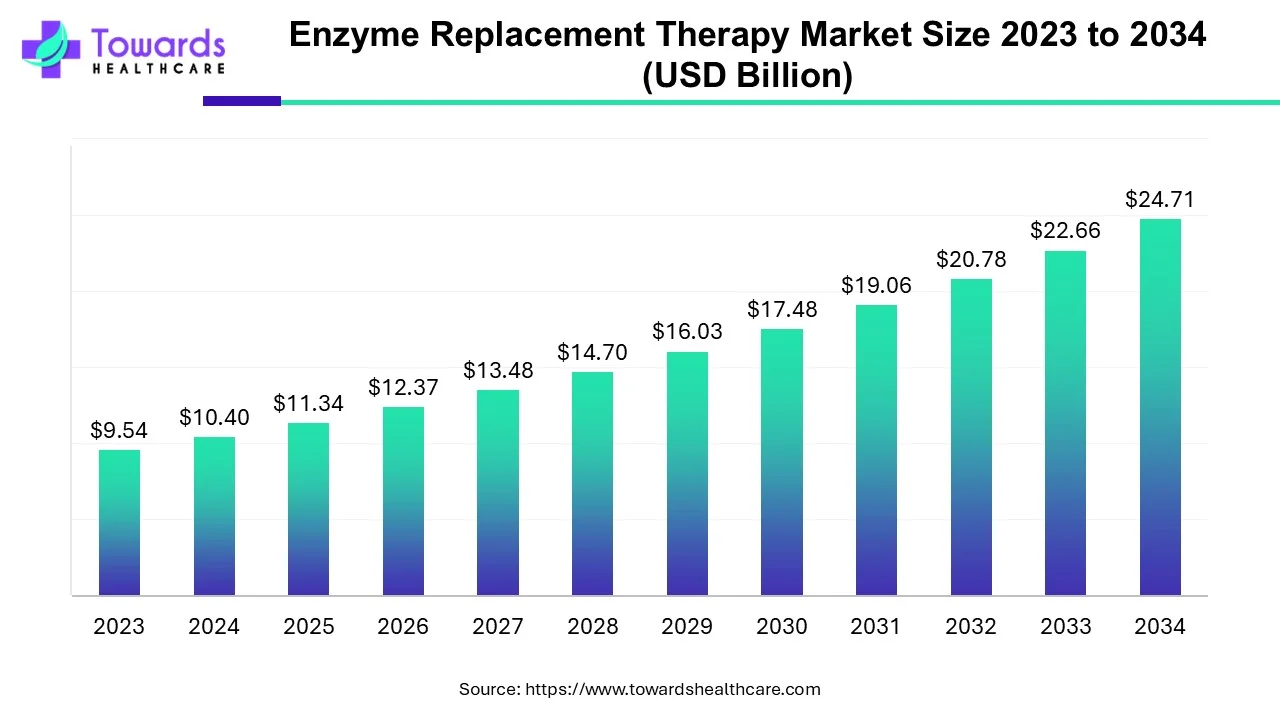

Enzyme Replacement Therapy Market Size Projects USD 24.71 Bn by 2034

The enzyme replacement therapy market size is calculated at USD 11.34 billion in 2025 and is expected to reach around USD 24.71 billion by 2034, growing at a CAGR of 9.04% for the forecasted period.

Ottawa, Sept. 24, 2025 (GLOBE NEWSWIRE) -- The global enzyme replacement therapy market size was valued at USD 10.4 billion in 2024 and is predicted to hit around USD 24.71 billion by 2034, rising at a 9.04% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Because of increasing prevalence of rare genetic and metabolic disorders along with improving diagnostic tools, better regulatory support, and advances in biotechnology solutions, demand for enzyme replacement therapies is surging globally.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5406

Market Overview:

The market for Enzyme Replacement Therapy (ERT) is continuously growing, fuelled by the increasing recognition of the importance of enzyme replacement therapy for patients and health care professionals and payers treatment of conditions related to enzyme deficiency disorders and, specifically lysosomal storage disorder indications. With this recognition the anticipated goals of morbidity reduction, quality of life improvement, and sometimes longevity will become a standard expectation of care.

In conjunction with enhanced knowledge about early diagnosis and treatment, there is improvement in prospects of morbidity reduction, quality of life, and longevity. Biotech advancements toward producing recombinant enzymes and improved purification methods, continue to contribute toward safer and more effective therapies.

Major Growth Drivers

One of the key factors is the increasing incidence and identification of inherited metabolic disorders and lysosomal storage diseases. With the expansion of newborn screening programs and genetic testing, more cases which would have previously gone undiagnosed are diagnosed early, resulting in demand. In addition, biotechnological advances are yielding enzymes with higher purity, greater stability and often better pharmacokinetics.

Regulatory and policy efforts also contribute: multiple national and international organizations are providing expedited pathways, orphan drug designations and favourable reimbursement for rare diseases. In addition to these factors, increasing investment in healthcare, primarily in developing markets, is facilitating access to costly biological therapies. Patient advocacy and real-world evidence are working against barriers in stigma, awareness and diagnostic delays. Finally, the expansion of product pipelines and exploration of new indications is rendering the market anticipatory and dynamic.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Key Drifts:

One of the primary developments is the progression toward alternative routes of administration, including developing more oral and subcutaneous formulations rather than standard IV infusions, due to patient desire, ease of use, and cost, in light of treatment of conditions that require frequent dosing.

Given that many ERTs are high-cost biologics, manufacturers are now challenging financial models by pursuing the development of biosimilars or analogues to their original products, developing cost-efficient manufacturing strategies and finding partners to reduce the cost of goods.

ERTs are being initiated earlier in the disease spectrum, including patients with less severe phenotypes and both approved and under study for additional manifestations. New indications including non-neural manifestations or as a part of combination therapy are emerging.

Significant Challenge:

High Cost & Reimbursement Barriers:

A continuing and major barrier in the enzyme replacement therapy market is the extremely high cost of therapy. Producing biologic enzymes with the necessary purity, stability, and safety is expensive, and the prices of many therapies reflect this expense. Many healthcare systems or insurers are not willing to reimburse the full cost of therapy, particularly in lower or middle-income countries.

In addition, individuals from emerging regions may have to wait to receive treatment due to the absence of coverage or delay in approval of treatment. Regularly scheduled, often life-long, infusions require a level of infrastructure to administer the therapy, resulting in added logistical cost. Immune responses, infusion-related adverse events, or issues relating to the chain of supply add additional complexity with respect to cost and access. So, although demand for enzyme replacement therapy is very high, actual uptake may be limited due to complex financial, regulatory, and infrastructure issues.

Regional Analysis:

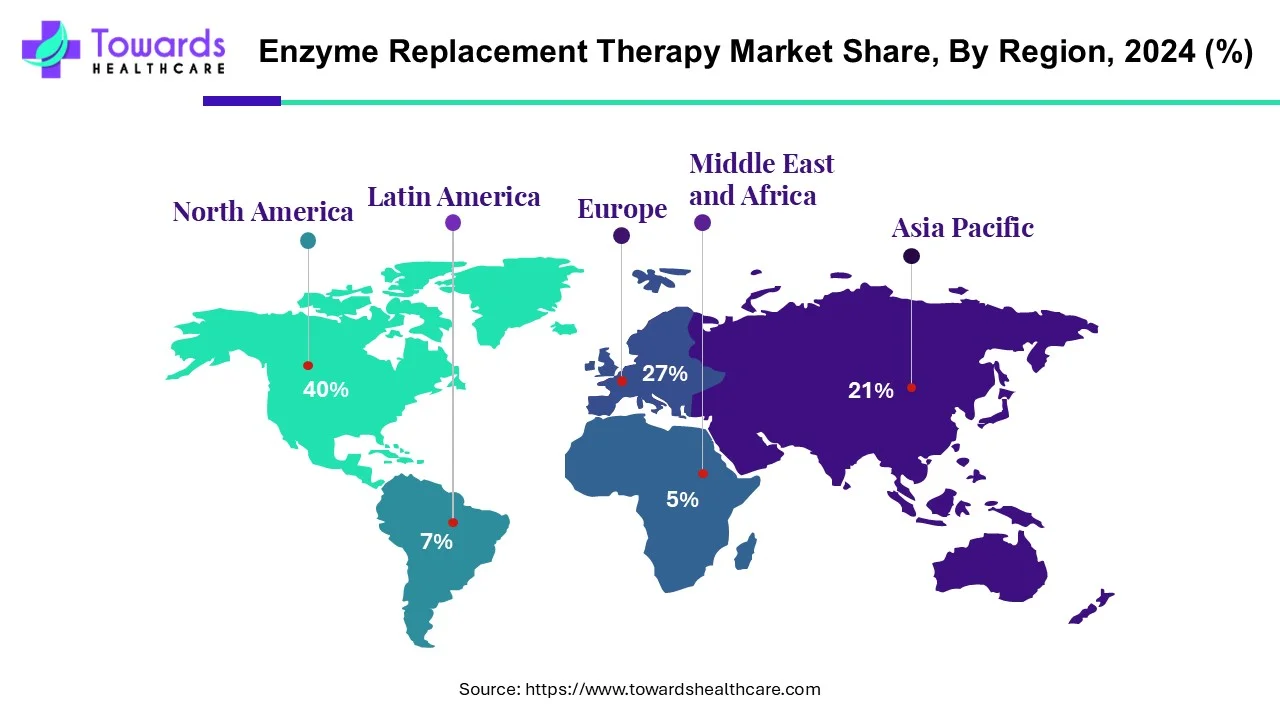

By overall indication North America represents the largest segment by 40% of the enzyme replacement therapies market with its advanced healthcare infrastructure, early adoption of policies supporting treatment of rare diseases, a strong presence of leading biotech and pharmaceutical organizations, substantial spending on biologics, and favourable reimbursement policies.

In comparison, the Asia-Pacific region represents the fastest growing region as it is experiencing growing awareness of rare diseases, expanding diagnostic and genetic screening capabilities, increasing healthcare investment, improved regulatory support for orphan indications, and expanding patient populations.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By Product

The imiglucerase segment is the largest product category in the ERT market, due to its long history of use in Gaucher disease, its established efficacy and safety, and extensive regulatory approval.

The agalsidase beta segment is the fastest growing product segment, driven by increased diagnoses of Fabry disease, heightened patient awareness, and a favorable action profile of the enzyme. Both manufacturers and health care systems are meeting unmet needs of the Fabry patient community, contributing to increased adoption of agalsidase beta.

By therapeutic condition:

The Gaucher disease segment is dominating the therapeutic condition split. Because Gaucher disease has one of the larger diagnosed rare disease populations and multiple approved ERTs, its market share is highest among ERT-treated conditions.

The MPS segment is the fastest growing therapeutic condition segment. Growth in MPS is driven by newer subtypes being diagnosed, expanding availability of MPS-specific therapies, and enhanced disease awareness and screening.

By Route of Administration:

The parenteral segment is currently the largest, as most existing ERTs are delivered through infusion to provide direct delivery of the enzyme with a consistent clinical effect. The oral segment is the fastest growing route of administration. Although there are limited oral ERTs available, there is continued research and development of oral therapies for enzymes or enzyme stabilizers, along with patient demand for low-invasiveness.

By End-Use:

Infusion centers are the most common end-use segment, primarily because they are specialized to provide safe infusion of intravenous enzyme therapies, manage adverse effects, and make treatment observations. Infusion centers currently provide the majority of ERT infusions globally.

In contrast, hospitals are the most rapidly adopted form of end-use segment, characterized by growth in emerging markets. Hospitals are expanding because they are establishing rare disease units, improving facilities to support biologics, and acting as centers for the diagnosis, administration and follow up for ERT treatment.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments:

In July 2025, BioMarin announced it will acquire Inozyme Pharma for about USD 270 million, strengthening its pipeline in enzyme replacement therapy. Inozyme is developing a therapy for children deficient in the ENPP1 protein, a genetic condition affecting blood vessels, soft tissue, and bones.

Top Companies in the Enzyme Replacement Therapy Market

- AbbVie

- Alexion Pharmaceuticals, Inc.

- Amicus Therapeutics

- AstraZeneca plc

- Biomarin Pharmaceutical, Inc.

- Denali Therapeutics, Inc.

- GC Biopharma

- Genzyme Corporation

- Novel Pharma

- Pfizer, Inc.

- Protalix BioTherapeutics, Inc.

- Sanofi

- Takeda Pharmaceuticals

Browse More Insights of Towards Healthcare:

The physical therapy clinics back-office software market is witnessing rapid global advancement, with revenues expected to climb into the hundreds of millions between 2025 and 2034.

The electron brachytherapy market is valued at US$ 451.36 million in 2024, rising to US$ 494.33 million in 2025, and is forecast to reach nearly US$ 1.12 billion by 2034, growing at a CAGR of 9.52% during 2025–2034.

The brachytherapy market stood at US$ 1.04 billion in 2024, expanded to US$ 1.12 billion in 2025, and is anticipated to generate close to US$ 2.10 billion by 2034, reflecting a CAGR of 7.27% over the forecast period.

The cell and gene therapy thawing equipment market reached US$ 0.96 billion in 2024, advanced to US$ 1.1 billion in 2025, and is projected to soar to about US$ 3.56 billion by 2034, recording a robust CAGR of 14.24%.

The cell and gene therapy tools and reagents market was valued at US$ 10.04 billion in 2024, grew to US$ 11.12 billion in 2025, and is forecast to climb to nearly US$ 27.3 billion by 2034, expanding at a CAGR of 10.76%.

The viral vector-based cell & gene therapy CDMO market accounted for US$ 142.77 million in 2024, reached US$ 162 million in 2025, and is predicted to hit around US$ 497.7 million by 2034, advancing at a CAGR of 13.44%.

The cell and gene therapy bioassay services market totaled US$ 5.05 billion in 2024, grew to US$ 5.67 billion in 2025, and is expected to achieve approximately US$ 16 billion by 2034, registering a CAGR of 12.24%.

The cell and gene therapy manufacturing QC market recorded US$ 2.66 billion in 2024, rose to US$ 3.11 billion in 2025, and is projected to reach nearly US$ 12.35 billion by 2034, showcasing a strong CAGR of 16.89%.

The cell and gene therapy (CGT) pharmaceuticals market stood at US$ 16.75 billion in 2024, expanded to US$ 19.91 billion in 2025, and is forecast to surge to almost US$ 91.56 billion by 2034, advancing at an impressive CAGR of 18.93%.

The cell and gene therapy cold chain logistics market was valued at US$ 1.89 billion in 2024, rose to US$ 2.19 billion in 2025, and is expected to touch nearly US$ 8.06 billion by 2034, growing at a CAGR of 15.64% throughout the forecast horizon.

Segments Covered in the Report

By Product

- Imiglucerase

- Agalsidase Beta

- Alglucosidase Alfa

- Taliglucerase

- Velaglucerase Alfa

- Pegademase

- Laronidase

- Pancreatic Enzymes

- Idursulfase

- Galsulfase

- Others

By Therapeutic Condition

- Gaucher Disease

- MPS

- SCID

- Pompe Disease

- Fabry Disease

- Others

By Route of Administration

- Parenteral

- Oral

By End-Use

- Infusion Centers

- Hospitals

- Others

By Region

- North America

- US

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5406

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.